The Retirement & Compensation Fund for Private Schools Won “The Best Pension Plan Sponsor in Taiwan” Award

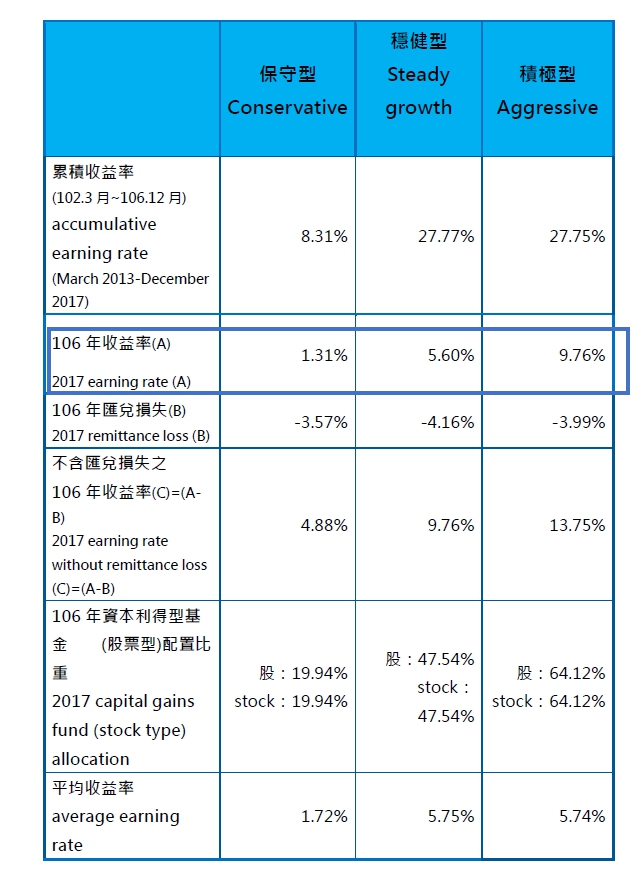

The MOE said that the Retirement & Compensation Fund for Private Schools has been engaging in autonomous investment for more than 4 years, beginning from March 1, 2013. The earning rates for its three different types of investment portfolios in 2017 were: 1.31% (conservative), 5.60% (steady) and 9.76 % (aggressive). If we include about 4% of the remittance loss, the performance for all types of investment portfolios will seem even more remarkable.

To provide a better retirement plan for private school teachers and staff members, the MOE released a fourth type of investment portfolio, the “Life-Cycle Fund”, on September 28, 2017; this was in addition to the current “conservative”, “steady growth” and “aggressive” investment portfolios. Life-Cycle Fund’s investment strategy aims to reduce the allocation of higher- risk assets as the investor ages. Thus this strategy automatically adjusts the allocation of the three types of investment portfolios according to the investors’ (private school teachers and staff members) age: “aggressive at a younger age, steady growth in middle age, and conservative near retirement.” Moreover, this retirement plan has a guaranteed remuneration mechanism which protects the rights and interests of private school teachers and staff members.